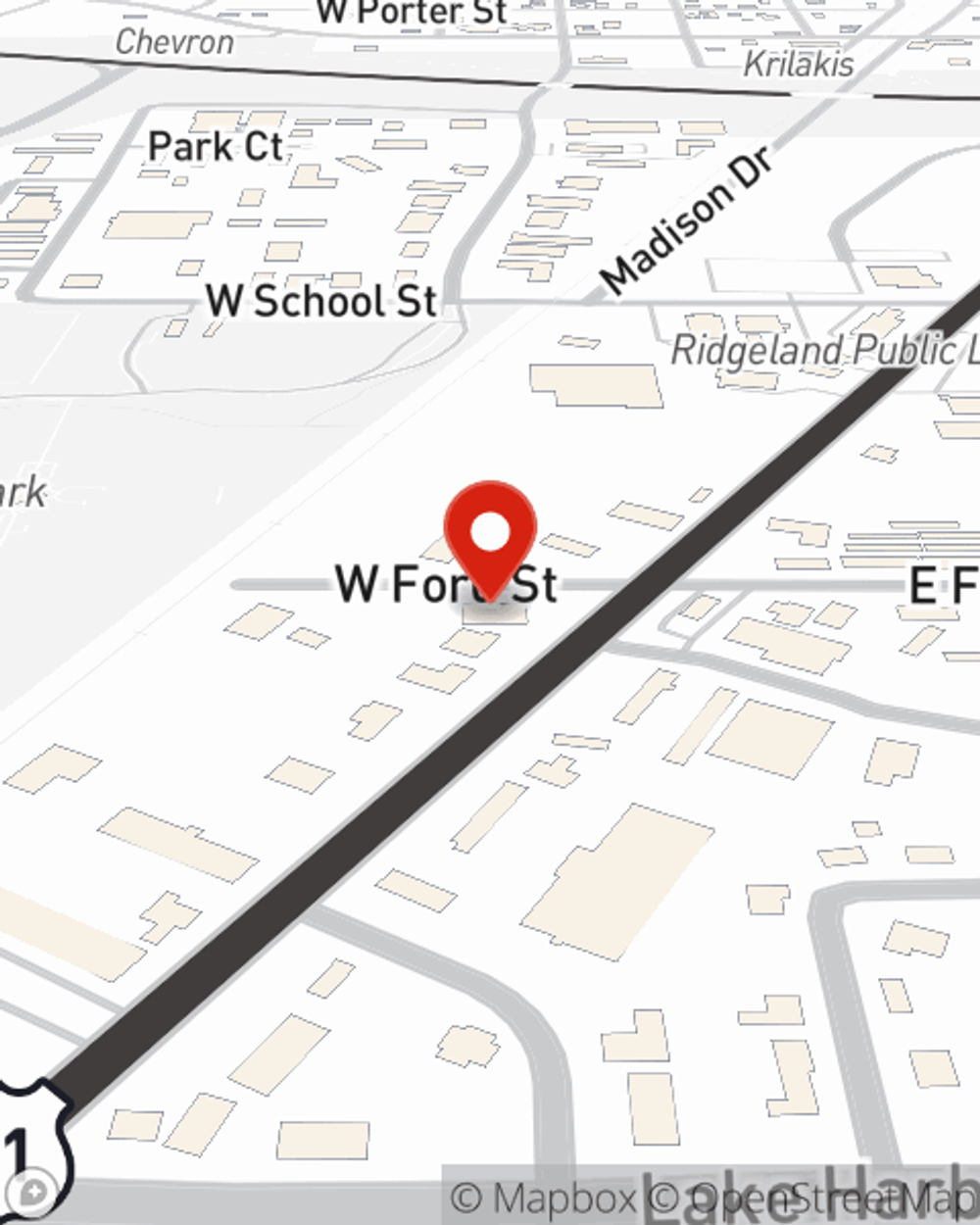

Business Insurance in and around Ridgeland

Researching coverage for your business? Search no further than State Farm agent John Dorsa!

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, worker's compensation for your employees and business continuity plans, among others.

Researching coverage for your business? Search no further than State Farm agent John Dorsa!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

Whether you own an ice cream shop, a beauty salon or a tailoring service, State Farm is here to help. Aside from exceptional service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent John Dorsa is here to consider your business insurance options with you. Reach out John Dorsa today!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

John Dorsa

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.